Learn All About CPA Exam Pass Rates and Recent Scores

If you’re on the CPA journey, one crucial aspect is successfully earning a CPA exam passing score. In addition, CPA exam pass rates play a vital role in understanding the difficulty and success rates associated with this challenging examination. After all, how can you prepare to hit a target if you don’t know what/where the target is?

In this comprehensive guide, we will delve into the world of CPA pass rates, explore recent scores, and provide valuable insights for each and every CPA exam candidate.

Significance of CPA Pass Rates

Passing the CPA exam is a prerequisite for obtaining the CPA designation. Therefore, understanding CPA pass rates is crucial for candidates who aim to become certified public accountants. In addition, CPA exam pass rates provide insights into the difficulty level of the exam, the effectiveness of study materials and review courses, and the overall success rates of candidates.

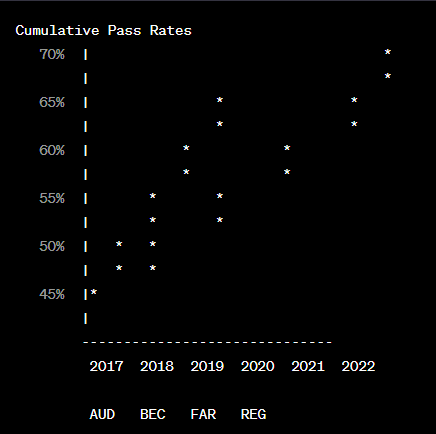

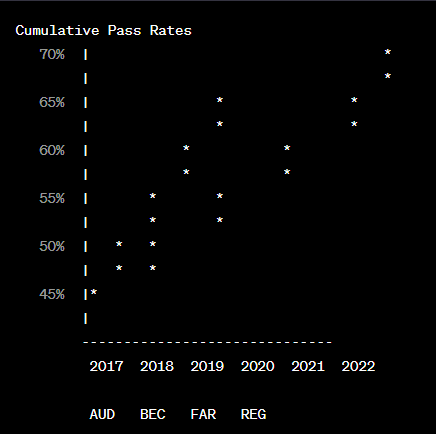

2022 CPA Exam Pass Rates

| 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter | Average | |

| AUD | 46.35% | 49.13% | 61.25% | 47.21% | 47.90% |

| BEC | 57.33% | 61.53% | 59.91% | 60.30% | 59.85% |

| FAR | 44.95% | 45.66% | 44.30% | 40.67% | 43.76% |

| REG | 60.03% | 61.25% | 61.78% | 56.41% | 59.85% |

Examining CPA Exam Pass Rate Statistics

Various organizations and institutions compile and publish CPA pass rate statistics, making analyzing and interpreting recent scores easier. These statistics offer a comprehensive overview of the success rates among candidates who have taken the exam in different testing windows or quarters.

By examining historical trends and changes in pass rates, candidates can gain valuable insights into the exam’s evolution and adapt their study strategies accordingly.

Factors Affecting CPA Exam Pass Rates

The difficulty level of the exam, determined by the American Institute of Certified Public Accountants (AICPA), plays a significant role. In addition, the quality of CPA review courses and study materials can impact candidates’ preparedness and success rates. Finally, factors such as the candidate’s level of preparation, study habits, and ability to manage time effectively contribute to pass rates.

Interpreting CPA Exam Pass Rates

Interpreting CPA pass rates requires understanding the pass/fail threshold and the exam’s scoring system. While the passing score is uniform across all jurisdictions, the actual pass rates may vary based on the candidates’ abilities and the quality of their preparation. Therefore, comparing CPA pass rates to those of other professional exams can offer valuable benchmarks for assessing performance and understanding the exam’s relative difficulty.

2021 Exam Pass Rates

| 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter | Average | |

| AUD | 48.56% | 50.49% | 47.21% | 45.04% | 47.98% |

| BEC | 62.16% | 63.31% | 61.73% | 60.27% | 61.94% |

| FAR | 46.64% | 42.63% | 47.83% | 44.54% | 44.54% |

| REG | 59.29% | 58.81% | 63.12% | 57.78% | 59.88% |

Strategies for Improving CPA Exam Performance

Candidates can enhance their chances of success on the CPA exam by implementing effective study techniques, such as creating a comprehensive study plan and managing their time efficiently. Choosing the right CPA review course and study materials tailored to individual learning styles is crucial. Additionally, practicing exams and seeking guidance from experienced CPA professionals or tutors can significantly improve performance.

Recent Trends in CPA Exam Pass Rates

Analyzing recent trends in CPA pass rates allows candidates to stay updated with the exam’s evolving nature. Recent changes in the exam structure or content may impact pass rates, requiring candidates to adapt their study strategies accordingly. It is also essential to consider regional or jurisdictional variations in pass rates, as they may provide insights into specific challenges or strengths within different areas.

Factors to Consider When Analyzing CPA Exam Pass Rates

When analyzing CPA exam pass rates, it is crucial to consider the data’s sample size and statistical significance. Pass rates for first-time candidates may differ from those of repeat candidates, highlighting the importance of understanding these variations. Moreover, comparing pass rates across different testing windows or quarters can offer additional insights into the exam’s difficulty and candidates’ performance.

| Rank | Institution | Pass Rate |

| 1 | University of Pennsylvania | 90.9% |

| 2 | Rice University | 90.8% |

| 3 | University of Texas – Austin | 89.5% |

| 4 | Brigham Young University | 89.4% |

| 5 | Wake Forest University | 88.8% |

| 6 | Morningside College | 88.5% |

| 6 | Michigan Technological University | 88.5% |

| 8 | Boston College | 88.3% |

| 9 | University of Michigan – Ann Arbor | 88.2% |

| 10 | Georgetown University | 86.4% |

| 19 | Florida University | 86.4% |

Looking at CPA exam pass rates by the school attended is another way to determine how difficult the exam is by year. It can also pinpoint which accounting schools are doing their best to prepare their students for the CPA exam.

Understanding the Implications of CPA Exam Pass Rates

CPA exam pass rates influence candidates’ confidence and motivation throughout the preparation process. They influence candidates’ confidence and motivation and shape accounting education and curriculum. They contribute to the perception of the CPA profession, reflecting rigor and standards associated with certification.

Tips for Success on the CPA Exam

Invest in a CPA test prep review:

- Enroll in a reputable CPA test prep course or program.

- Utilize practice exams, study materials, and online resources provided by the review course.

- Take advantage of interactive study tools and video lectures offered by the program.

- Seek guidance from experienced instructors or tutors available through the review course.

Create a study plan and schedule:

- Establish a structured study routine to cover all exam topics.

- Allocate sufficient time for each section of the exam.

- Set achievable goals and milestones to track your progress.

Familiarize yourself with the exam structure and content:

- Understand the format and requirements of each section (Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, and Regulation).

- Review the content specifications provided by the exam authority.

- Identify the weighting of different topics to prioritize your study accordingly.

Utilize a variety of study resources:

- Obtain comprehensive CPA review textbooks or study guides.

- Utilize online resources such as video tutorials, interactive quizzes, and practice questions.

- Seek out supplemental materials like flashcards or mnemonic devices to aid memorization.

Practice with sample questions and past exams:

- Solve a wide range of practice questions to become familiar with the exam format and types of questions.

- Access official sample questions and past exams provided by the exam authority.

- Analyze your performance and identify areas that require further attention.

Join a study group or find a study partner:

- Collaborate with fellow CPA exam candidates to discuss and clarify complex topics.

- Share study resources, tips, and strategies with each other.

- Engage in group discussions and quizzes to enhance understanding.

Take advantage of technology and online resources:

- Utilize CPA exam review apps or software for on-the-go studying.

- Access online forums and communities where candidates share their experiences and insights.

- Explore educational YouTube channels or podcasts dedicated to CPA exam preparation.

Stay organized and manage your time effectively:

- Create a study schedule and adhere to it.

- Break down complex topics into smaller, manageable sections.

- Prioritize challenging areas while reviewing topics you are already familiar with.

Take simulated practice exams:

- Simulate exam-like conditions by taking timed practice exams.

- Evaluate your performance and identify areas that need improvement.

- Analyze the questions you answered incorrectly to understand the underlying concepts.

Stay updated with changes in the CPA exam:

- Stay informed about any updates or revisions in the exam structure or content.

- Regularly check the official website of the exam authority for announcements and updates for your CPA test day.

Conclusion

Understanding CPA pass rates and recent scores are crucial for aspiring certified public accountants. By exploring pass rate statistics, analyzing trends, and considering various factors affecting pass rates, candidates can make informed decisions about their study strategies.

By implementing effective study techniques, utilizing quality review materials, and seeking guidance when needed, CPA candidates can improve their exam performance and increase their chances of passing this challenging assessment.

The journey to becoming a CPA requires dedication, preparation, and a solid understanding of the pass rates associated with this esteemed profession.

Sources: