So, you want to elevate your future by earning an accounting designation or certification. Whether you plan to analyze tax return documents, help people solve tax problems, take tax matters or provide other services, there’s definitely a role out there for you.

But with so many options out there, it can be difficult to choose the right one. This is especially true for those pursuing further education in the accounting field since the time and money investment in doing so can be huge.

Today, we’ll discuss two of the most popular certifications available to tax professionals: Enrolled Agent vs CPA.

What is an Enrolled Agent (EA)?

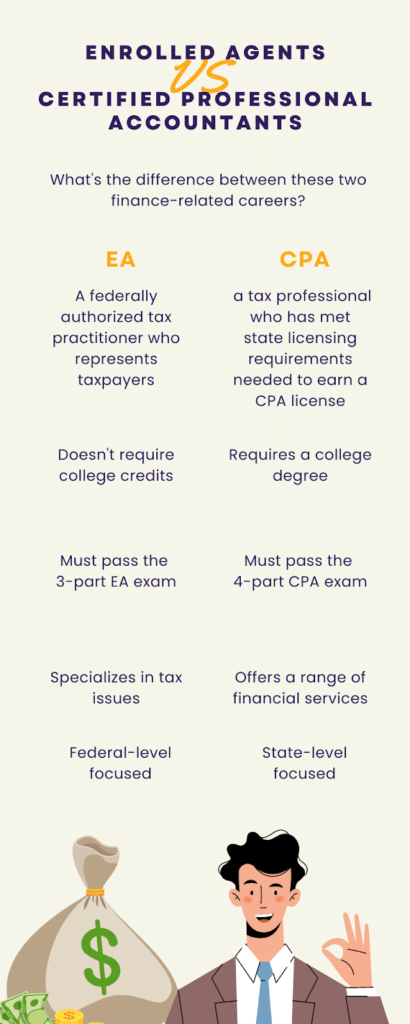

An enrolled agent, or EA, is a federally-authorized tax practitioner who represents taxpayers before the Internal Revenue Service (IRS). Per the Department of Treasury’s Circular 230 regulations, enrolled agents can advise or represent clients before the IRS regarding audits, collections, and appeals. Preparing tax returns is another common function of an EA.

EAs are not limited in their capacity to work with different types of clients. The IRS authorizes them to work with individuals, corporations, partnerships, trusts, estates, and other entities. The EA credential is considered the highest credential awarded by the IRS.

Many people who earn this certification go on to work for the federal government. Others work for tax attorneys. Some EAs even find a micro focus in a niche setting to use their expertise.

EA Qualifications

Before you can achieve EA status, you’ll need to make sure you meet a few essential qualifications. The good news is that you don’t need a college degree or previous experience to become an EA. While five years of working experience with the IRS is one way to go, you can also take the EA examination.

Let’s take a look at the basic requirements:

- Obtain a Preparer Tax Identification Number (PTIN)

- Pass all three parts of the EA examination within three years

- Apply for EA enrollment

- Pass a suitability check

Enrolled agents are also required to follow strict ethical standards to maintain their status with the IRS. This practice makes sense as tax specialists and tax preparers work with sensitive documents such as financial statements and audit information.

In addition to this requirement, once EA status is achieved, a minimum of 72 hours of continuing education courses must be completed every three years.

Although you don’t need a certain degree to be an EA, passing the exam isn’t easy. This is why an EA review course is highly recommended.

Save $349 on Gleim EA Traditional Course

What is a Certified Public Accountant (CPA)?

Are you more interested in learning how to become a CPA?

A Certified Public Accountant, also known as a CPA, is a tax professional who has met state licensing requirements needed to earn a CPA license via experience, training and passing an exam.

It’s important to note that CPA is not a job title or career path. Instead, it is a credential that allows accountants to diversify their client offerings and earn more money. CPAs are able to work with individual clients, business entities, trusts, and more. Some CPAs deal with taxation, while others focus on finances in a different way and never touch tax issues at all. CPAs often work for the “Big 4” accounting companies, but some opt to be self-employed business owners or work for non profit organizations.

According to the American Institute of Certified Public Accountants (AICPA), CPAs typically specialize in five areas:

- Auditing and review

- Litigation consulting

- Financial accounting and planning

- Consultation services

- Tax advice and tax preparation

Among the most common reasons that tax professionals choose to pursue a CPA designation include career development, job security, and job satisfaction. Many who consider becoming tax attorneys decide to become certified public accountants instead.

CPA Qualifications

If you want to become a CPA, you’ll need to meet a few basic requirements first. Contrary to the EA qualifications, you’ll need a minimum of 150 credit hours of college education under your belt in accounting practices, finance, or business administration to start your CPA journey. So, if you don’t yet have a degree, you’ll want to start there.

Depending on the state you live in, there may be additional requirements. For example, some states require accountants to have a minimum amount of professional accounting experience to take the CPA exam.

You’ll also need to pass all four sections of the CPA exam within 18 months to earn the certification. Some states also require tax professionals hoping to become CPAs to pass an ethics exam before the certification can be granted.

Take $1,600 Off UWorld CPA Elite-Unlimited Course

CPA vs EA Differences

Even though both CPAs and EAs work in the accounting sector, there are several differences between the designations. For instance, CPAs primarily focus on providing consultation services and tax return preparation. From filing a simple tax return to analyzing profit margins, CPAs have a great deal of financial expertise.

EAs, on the other hand, deal directly with the IRS as they represent taxpayers regarding audits, collections, and appeals. Complex tax issues, tax code, and tax planning are their specialties.

Since accountants with each certification specialize in different areas, the testing required to earn them is different, as well.

Let’s take a closer look at the difference between the EA and CPA exam.

CPA Exam Topics

The Uniform CPA Examination focuses on testing applicants in four areas to determine their readiness to perform CPA-related tasks. By requiring a passing score on the examination, states can ensure that CPAs in their jurisdictions have the skills and knowledge needed to do their jobs properly.

Let’s break down each section of the exam and what they cover:

- Auditing and Attestation (AUD): Auditing, attestation, compliance, regulations

- Business Environment and Concepts (BEC): Corporate finance, strategic planning, information technology, and economic concepts.

- Financial Accounting and Reporting (FAR): Financial analysis, financial reporting, and reviewing accounts and transactions.

- Regulation (REG): Business law, property transactions, taxation of individuals and businesses, tax code, and more.

CPA exams consist of a mix of multiple-choice questions, task-based simulations, and written communication tasks. They are scored by taking a weighted calculation of the individual scaled score of each section of the test. Possible test scores range from 0-99, and test takers must score a minimum of 75 to earn a passing grade.

The good news is that even if you fail the first time, you’ll be able to take advantage of unlimited retakes within an 18-month period. Testing sections can also be taken in any order of your choosing.

EA Exam Topics

The EA exam consists of 100 multiple-choice questions split up into three sections. Each of the test sections is also broken down into smaller sub-sections that cover a variety of information you’ll need to know to be successful as an EA.

Let’s examine what the sections of the EA exam are and what they cover:

- Section 1: Individuals: Section 1 covers preliminary work and taxpayer data, income, assets, deductions, credits, taxation advice, advising individual taxpayers, and specialized individual tax situations.

- Section 2: Businesses: Section 2 tests your knowledge of business financial planning and specialized tax returns for a variety of business structures such as partnerships, C Corporations, exempt organizations, and more.

- Section 3: Representation, Practices, and Procedures: Section 3 deals with practices, procedures, representation before the IRS, and completing the filing process.

Similarly to the CPA exam, you’ll have the freedom to choose the order in which you take each section of the EA exam. However, you won’t have unlimited retakes if you fail. The EA examination allows up to 4 retesting sessions per testing window.

CPA vs EA Exam Difficulty

Whether you’re considering becoming a CPA or EA, you’ll need to pass a test to earn the certification.

That might leave you wondering just how difficult it will be to earn a passing score.

The best way to gauge exam difficulty is by examining the most recent pass rate data for each test. Currently, the pass rate for the EA three-part exam is an impressive 74%. On the other hand, the CPA passing rate currently reports around 50%.

One important consideration you’ll need to take into account when comparing the EA and CPA exams is what is required to take them. While neither requires a college degree to attempt the exam, most people who pursue EA status have at least some prior professional knowledge of accounting or a background as tax professionals.

Since test takers can attempt the CPA exam before finishing school or starting their careers, it’s safe to say that at least a portion of those who fail have little to no real-world experience in the field. Lacking this vital knowledge can make it more difficult to pass.

CPA vs EA Time Requirement Differences

One of the critical things you’ll need to consider when choosing between an Enrolled Agent vs CPA is the time investment you’ll need to put toward earning the certifications.

Depending on your level of experience, you can expect to earn an EA designation in as little as three to eight months. This includes the recommended 40 to 70 recommended study hours you’ll need to pass the exam on your first attempt and the processing times required to review and approve the applications needed to gain the status.

Since you’ll need to complete schooling before you can become a CPA, you can expect to spend around seven years pursuing the designation. The 150 credit hours required to earn the certification equates to about 4 to 5 years of schooling. Then, it’s recommended that you spend anywhere from 80-120 hours studying for the CPA exam.

CPA vs EA Career Paths

The most exciting part about becoming an EA or CPA is the career path opportunities they offer.

Let’s explore a few options.

As a CPA, you can further your career as a tax professional in a few different ways. The certification qualifies you to work in corporate banking, financial analytics, and corporate finance and accounting, to name a few.

Since a portion of the CPA exam also focuses on financial planning, you can use that to your advantage to prepare and help individuals or businesses with investment and tax planning, as well.

There is no shortage of career path options available for people with an EA certification. As a certified EA, you can pursue a career in several fields:

- Tax preparation

- Banking

- Tax attorney

- Banking

- Investment

- Department of Revenue

CPA vs EA: Which is Better?

The truth is, comparing CPA vs EA is like comparing apples vs oranges. The right designation for you depends on your personal interests, career goals, and desire to succeed. If you’re looking for the quickest and easiest option, for example, becoming an EA requires less time investment, and pass rates for the exam are relatively high.

However, becoming a CPA gives you the opportunity to earn more money and enables you to pursue many lucrative career paths that help you live a fulfilled life. If you pursue a college education in business administration or finance as a stepping stone to the CPA certification, you’ll also have options in a wider array of fields for your career.

The bottom line? No certification or designation is right for everyone. You’ll need to look inward to make the right decision for you.

FAQ

A: In terms of pass rates and the amount of time it takes to earn, the CPA certification is the more difficult of the two. However, the earning potential and career path options it offers make it well worth it.

A: Enrolled Agents are among the most respected tax professionals, especially to the IRS. In fact, the EA is the highest credential awarded by the federal agency.

A: The best way to compare exam difficulty of the EA and CPA is by considering pass rates. The EA exam currently boasts a 74% pass rate, while the CPA exam has a 50% pass rate. It’s safe to say that the EA exam is easier than the CPA exam.

Sources: