Key Takeaways

Earning the CMA designation offers job security and higher salary prospects, but it requires meeting educational and experience qualifications set by the IMA. This includes holding a bachelor’s degree or a related certification, having work experience in management accounting or financial management, passing the two-part CMA exam, and adhering to ethical standards. CMAs also need to fulfill annual CPE requirements to stay current in their field.

If you’re looking for CMA exam requirements, you’re already ahead of the game. Becoming a Certified Management Accountant (CMA) is the global benchmark for financial professionals involved in management accounting.

Why?

Earning this designation proves to employers that you have a deep understanding of how and why numbers add up during accounting.

It can also help you with job security and a higher salary.

Completing the CMA exam and earning your CMA certification can enhance your credibility, increase your earning potential, and lead to much better management positions wherever you work.

For many, this means that becoming a CMA is a valuable next step in any accountant’s career path.

Of course, you need to understand what you’re getting into before you can get started.

The path to Certified Management Accountant (CMA) has a strict set of educational and experience requirements mandated by the IMA (Institute of Management Accountants.) Before you can enroll in the CMA certification program, you’ll need to meet these CMA certification requirements. Plus, you’ll need to take the CMA exam after completing the necessary prerequisites.

This isn’t an easy process, however, meeting the CMA exam requirements is doable.

Now, let’s dive into the details.

CMA Exam Requirements: An Overview

Here are the CMA certification requirements for CMA candidates.

- You must hold an active membership with the IMA

- Fulfill the education qualification

- Fulfill the experience qualification

- Pay the CMA entrance fee

- Pass both parts of the CMA exam

- Comply with the IMA Statement of Ethical Professional Practice

- Complete the annual CPE requirements

Becoming an IMA Member

The first thing you need to do is become an IMA member. Non-members or inactive members can’t sign up for the CMA exam. This can be done before or after you’ve finished with the educational and work experience requirements.

You currently have 4 options when applying to become an IMA member. Each one has an initial application fee. Once your application is accepted, you’ll need to pay an additional fee based on which membership option you’ve chosen.

- First up is a 1-year student membership. Anyone currently enrolled with 6 or more credits at a college or university can choose this option to receive the benefits of a professional member for a reduced price. This can help you explore your career options and learn more about financial management for only $45 a year.

- You can also choose a 2-year student membership. This option has the same education requirements as above and offers the same benefits. However, you get two years of membership. The membership fee is $90.

- Next is the academic membership option. This membership grants you access to a wide range of educational materials: an ethics curriculum, case studies, mentorship programs, and more. It currently costs $150, but that price is halved for educators of accredited institutions.

- Your final option is to sign up for the professional membership program. This is the best choice for anyone planning on becoming an accountant or financial manager. Joining helps you stand out from the crowd, broaden your knowledge base, and sharpen your skills in finance. Currently, this membership option costs $275.

CMA Certification Requirements for Education

One major part of becoming a CMA is meeting the educational requirements. Make sure to do this as soon as possible— it’s far more difficult to try and earn this certification without doing so.

Earning a Bachelor’s Degree from an Accredited College

All candidates need to complete a 4-year degree from an accredited college or university. This degree doesn’t have to be in management accounting, but it must be related to the professional certification in some way, such as a finance or accounting degree.

Those pursuing a certified management accountant (CMA) career path might take courses in management accounting, financial planning, strategic financial management, planning performance and analytics, and risk management accounting.

Alternatively, any unaccredited degrees can be evaluated by an independent agency for consideration towards the CMA education requirements. This independent agency or approved certifying organization will determine whether your degree will be accepted according to CMA requirements.

Degree Verification and Timeline

Not sure if your degree counts? Degrees are verified by emailing transcripts to IMA directly from your college or university. They can check your transcripts and see if they measure up to the CMA education requirement.

Are you still working on your degree? You can still work on CMA certification and take the CMA exams while furthering your education.

The IMA allows students to sit for the CMA exam before they’ve completed their degree. To do this, you must be registered for at least 6 credits per semester during the academic year to take the CMA exam. You will have to send proof of your degree to the ICMA within 7 years of passing the CMA exam.

Other Qualifying Professional Certifications

The CMA education requirement can also be met by holding a professional certificate for a related field. Of course, you must submit verification of this to the IMA.

These include:

- Certified Internal Auditor (CIA), Institute of Internal Auditors

- Chartered Financial Analyst (CFA), CFA Institute

- Certified Fraud Examiner (CFE), Association of Certified Fraud Examiners

- Certified Treasury Professional (CTP), Association of Financial Professionals

A full list of eligible certifications is available in IMA’s CMA handbook. Make sure to check in with this resource for a more detailed breakdown of what is expected from you in terms of education.

CMA Certification Work Experience Requirements

Experience and education requirements for the CMA don’t end with a degree. Next, you’ll need to submit proof that you’ve completed an acceptable amount of work experience to prove you’re ready to work as a CMA. It’s extremely important that you complete this quickly; unlike the education requirement, there are no alternatives to this step.

Anyone hoping to become a CMA must complete at least 2 years of professional experience in management accounting or financial management. Teaching also counts as related experience, so long as at least 60% of the course you’ve taught is related to accounting or finance above the introductory level.

CMA Exam Fees

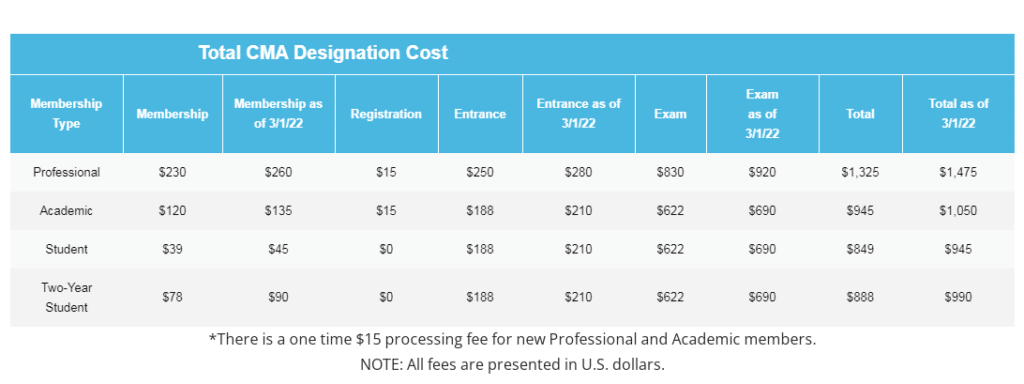

In addition to any costs incurred by meeting the education and membership requirements, you’ll have to pay CMA exam fees before you can finally sit for the CMA exam. Check out this table from Gleim to see a detailed breakdown of the costs for each membership level:

As you can see, your CMA fees and CMA entrance fee for the exam depend on the type of CMA annual fee you paid when applying for your IMA membership.

Passing the CMA Exam

Once you’ve met the CMA certification prerequisites, you’ll need to focus on passing the CMA Exam. This usually requires enrolling in a CMA program or CMA review course, but we will talk about that a little later.

First, let’s look at what future Certified Management Accountants

IMA currently separates the exam into 2 parts that can be taken in any order; passing both is what earns CMA candidates the CMA designation.

Each CMA exam consists of the following:

- 100 multiple-choice questions

- 2 essay questions

Students have 3 hours to complete the multiple-choice questions and 1 hour to complete the essay segment. In total, you’ll have four hours to finish the exam.

Some of the multiple-choice questions do not count towards your score and are being validated for use on future exams.

Topics Covered

Possible topics of focus include:

- Financial Planning, Performance, and Analytics

- Cost Management and Internal Controls

- Financial Statement Analysis and Strategic Financial Management

- Risk Management and Internal Controls

- Investment Decisions and Decision Analysis

- Corporate Finance and Corporate Governance

- External Financial Reporting Decisions

- Financial Statement Analysis

Other topics a CMA candidate may be tested on include

- Planning, Budgeting, and Forecasting

- Performance Management

- Analysis Risk Evaluation

- Cost Management Concepts

- Technology and Analytics

- Business Law and Ethics and Professional Ethics

- Corporate Governance and Social Responsibility

- Professional Ethics and Fraud Prevention

As you can see, the certification process and exam cover a lot of ground. This is why finding a great CMA program is one of the key steps to cover before you take the CMA exam. Such a program will be based on the IMA’s content specification outline.

What Makes a Good CMA Review Course?

You can check out our list of the best CMA review courses here.

When choosing a course, you’ll want to look for one that is:

Comprehensive Content Coverage: A good CMA review course should cover all the topics and subtopics outlined in the CMA exam syllabus, providing detailed explanations, examples, and practice questions for each area.

Exam-Oriented Approach: The course should focus on the specific content, question formats, and exam structure of the CMA exam, ensuring that students are well-prepared for the actual exam experience.

Abundant Practice Questions and Mock Exams: The course should offer a substantial number of practice questions, including multiple-choice and essay questions, with varying difficulty levels. Mock exams should simulate the format and timing of the actual CMA exam to provide an accurate assessment of readiness.

Interactive Learning Materials: Engaging video lectures, interactive quizzes, and simulations should be available to facilitate active learning and improve understanding of complex topics.

Personalized Study Plans: The course should provide personalized study plans based on individual strengths and weaknesses, helping students allocate their study time effectively and focus on areas that require improvement.

Expert Guidance and Support: Access to knowledgeable instructors or subject matter experts should be available for students to ask questions, seek clarification, and receive guidance throughout the course.

Progress Tracking and Performance Analytics: The course should offer tools for students to track their progress, view performance analytics, and identify areas of weakness to prioritize further study and improvement.

Up-to-Date Material: The course materials should be regularly updated to align with the latest CMA exam syllabus and any changes in content or question formats.

Flexibility and Accessibility: The course should provide flexibility in terms of study schedule and access, allowing students to study at their own pace and providing mobile-friendly platforms or apps for studying on different devices.

Positive Reviews and Success Rates: It is important to consider the reputation and success rates of the CMA review course, including feedback from past students who have used the course to pass the CMA exam successfully.

Scores are released about 6 weeks after the month in which you took the CMA exam. You will receive your scores via email and your personal MyIMA transcript.

Complying with the IMA Statement of Ethical Professional Practice

Complying with the IMA Statement of Ethical Professional Practice is an integral part of the CMA certification requirements. As financial professionals, CMAs are entrusted with sensitive financial information and play a crucial role in upholding the highest standards of integrity and ethical behavior.

The IMA Statement of Ethical Professional Practice outlines the fundamental principles and ethical responsibilities that CMAs must adhere to, including maintaining confidentiality, acting with honesty and objectivity, avoiding conflicts of interest, and continuously pursuing professional development. By requiring candidates to comply with this code of ethics, the

CMA certification ensures that CMAs are equipped with the necessary ethical framework to make sound financial decisions and contribute to the ethical culture of their organizations.

Upholding ethical standards is not only a requirement for CMA certification but also a commitment to maintaining professional credibility and trust within the field of management accounting.

Completing the annual CPE requirements

Completing the annual Continuing Professional Education (CPE) requirement is the final component of CMA certification. The CMA designation signifies a commitment to ongoing professional development and staying abreast of industry advancements. The Institute of Management Accountants (IMA) requires CMAs to accumulate a specified number of CPE credits each year to maintain their certification.

These credits can be earned through various educational activities, such as attending conferences, seminars, webinars, or participating in professional development programs. The purpose of CPE requirements is to ensure that CMAs stay current with evolving trends, best practices, and regulations in the field of management accounting.

By continuously enhancing their knowledge and skills, CMAs are better equipped to provide valuable insights, make informed business decisions, and contribute to their organizations’ success. Moreover, fulfilling the annual CPE requirements demonstrates a commitment to professional growth and reflects the dedication of CMAs to maintaining the highest standards of competence and expertise in their profession.

CMA Exam FAQs

Still curious about how to qualify for and pass the CMA exam? Check out these answers to some frequently asked questions to learn more!

Q: Is CMA harder than CPA?

A: Generally speaking, the CPA exam is considered more difficult than the CMA exam. Both have similar prerequisites, but the CPA exam consists of 4 tests that need to be passed within 18 months of each other. Plus, the CPA pass rates tend to be much lower.

Q: Is CMA better than CPA?

A: The answer here depends on what you plan on doing as your career. Earning a CPA designation is excellent for general accounting, but those interested in management should focus on the CMA. Neither one is strictly better than the other overall.

Q: Which is best, MBA or CMA?

A: Once again, this is largely up to the individual. Earning a CMA is much faster— but it must be maintained via annual fees and continuing education. However, the MBA will give you a more diverse education and has no post-degree costs. One final thing to consider is that earning an MBA is far more expensive than earning a CMA.

Q: How hard is the CMA exam?

A: The CMA exam is considered to be very difficult and has a passing rate of under 50% for both parts. Most recently, Part 1 had a passing rate of 34% and 46% on Part 2, according to the Institute of Management Accountants (IMA).

Q: How to pass the CMA exam?

A: You should plan to study for around 150 hours for each section, for a total of 300 hours. Break that down over time to prepare for your studies, which should include getting a CMA review course to help you along the way.

Q: What degrees are best for someone considering the CMA exam?

A: If you have a degree or considering which one is best to get into the accounting field, you should have a bachelor’s degree in accounting, finance, economics, or even business.